MSCI Resources for Measuring and Managing the Impact of Climate Change on CRE

May 17, 2022

Jonathan Rivera

Director

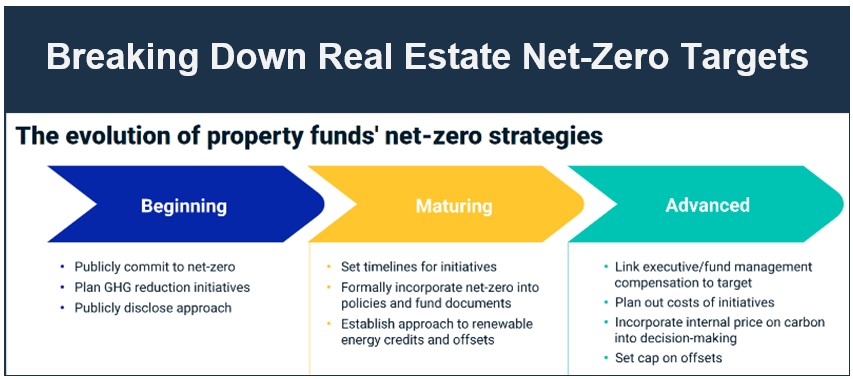

As a follow-up to my article on The Impact of Climate Change on Real Estate Valuations and Decisions, I would like to acknowledge the expertise and analysis of MSCI with respect to this important topic. MSCI has developed comprehensive climate change resources for real estate investors. These fall into two main categories: specific strategies for achieving net-zero decarbonization targets for real estate portfolios, as well as tools and methodologies that help measure and manage climate risk. MSCI has published the following report that outlines an approach that can evaluate a real estate fund’s strategy towards net-zero:

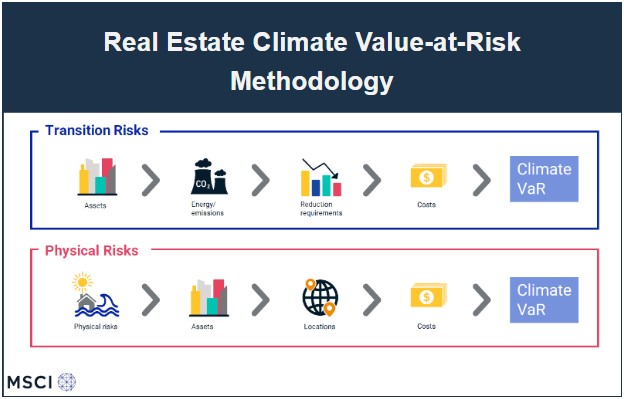

For the costs of energy transition and the physical risks of climate change, MSCI summarizes methods for evaluating these specific risks:

While these categories may seem separate (the push towards net-zero decarbonization vs. the cost impact of climate change on real estate), they are really interconnected. Of the long-term risks that climate change poses to real estate, the direct threat of extreme weather events is the most obvious. However, the other equally important factor is transition risk. Spurred by government regulation, efficiency, and corporate social responsibility, real estate funds will be moving their buildings towards net-zero. This inevitable transition poses long-term risks that are also not currently being priced into real estate valuation. MSCI’s approach to develop comprehensive strategies for net-zero commitments of real estate funds helps to quantify one of the important transition risks of climate change.