Self-Storage REIT Update – July 2025

July 23, 2025

July 2025 Self-Storage REIT Update: Now Available

In today’s complex and shifting real estate environment, few sectors have demonstrated the resilience and adaptability of self-storage. Capright’s newly released Self-Storage REIT Update – July 2025 takes a comprehensive look at the data, trends, and developments shaping one of CRE’s most reliable asset classes.

Please enter your email to download the report

🔍 Sector Snapshot

With over 2.1 billion square feet of rentable space across 52,000+ facilities in the U.S., self-storage continues to attract institutional capital despite broader market headwinds. While the pandemic-era demand surge has cooled, performance remains historically strong, especially in high-growth regions like the Sunbelt.

📊 Key Highlights from the July 2025 Report

📉 Performance Trends

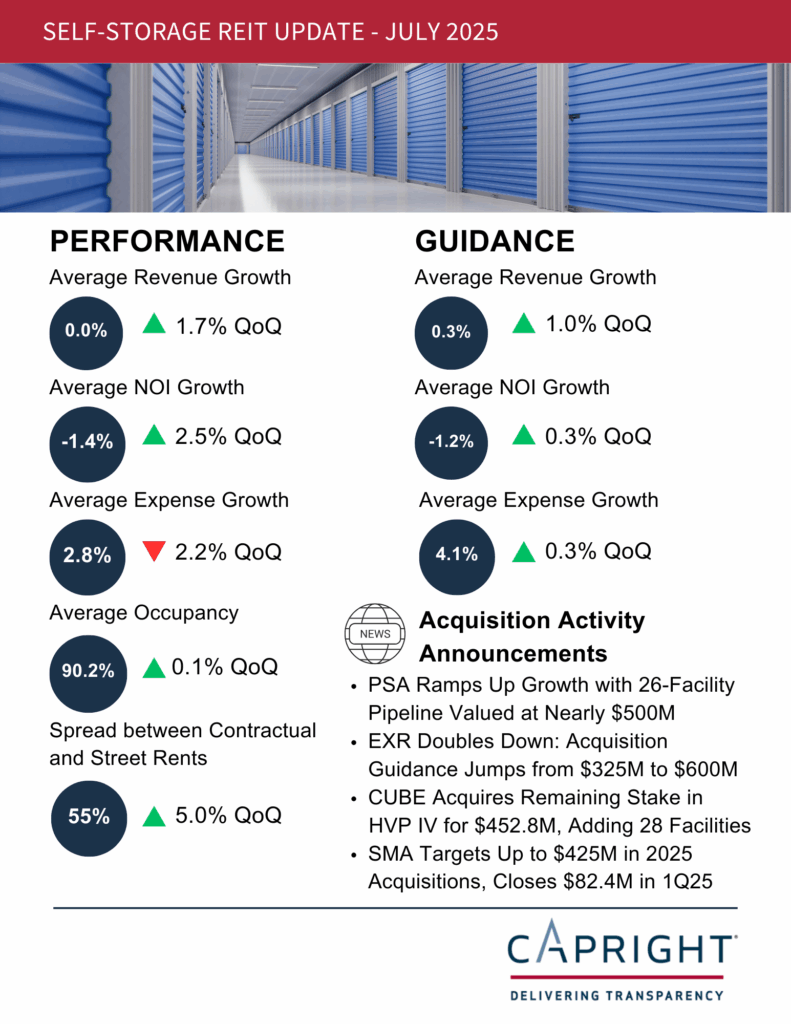

• NOI and Revenue Pressures: Slowing rent growth and elevated expenses have pushed NOI guidance into negative territory across four of the five major self-storage REITs.

💸 Street vs. Contract Rent Spread

• The spread between street rents and contract rents has widened significantly, now averaging 55%.

• This reflects aggressive concession strategies to attract new tenants, followed by existing customer rent increases (ECRIs) once tenants are in place.

🏗️ Acquisition Activity

• EXR increased its 2025 acquisition guidance from $325M to $600M.

• PSA is moving forward with a $500M+ development pipeline, focusing on long-term yield.

🌎 Market Outlook

• As new construction slows and interest rates remain elevated, many markets are expected to absorb current supply in the 2H25.

• Sunbelt metros, particularly in Texas and Florida, remain hotspots for investor interest, though oversaturation risk still looms in select submarkets.

💬 Insights & Strategic Takeaways

While near-term NOI projections remain weak, the self-storage sector continues to benefit from:

• Sticky tenant behavior

• Low capex requirements

• Strong institutional demand

• Advanced pricing strategies and tech integration

The long-term fundamentals remain compelling, especially as urbanization, housing turnover, and e-commerce continue to drive demand.

📬 Let’s Talk

At Capright, we are uniquely positioned to support institutional investors, operators, and developers navigating this evolving environment. As an independent valuation and advisory firm, we provide clarity, accuracy, and confidence, especially where the stakes are highest.

If you’d like to discuss the findings or need support with your Self-Storage valuation or strategy, reach out to:

For more information on the self-storage sector, please reach out to:

Principal

(847) 903-6679

📧 dticus@capright.com

🔗 Connect on LinkedIn

Principal

(813) 215-7071

📧 koxtal@capright.com

🔗 Connect on LinkedIn

Associate

(786) 797-0228

📧 imendoza@capright.com

🔗 Connect on LinkedIn