Data Center Market Update – October 2025

October 22, 2025

Please enter your email to download the report

Growth, Complexity, and the Next Wave of Opportunity – Data Center Market Update October 2025

The U.S. data center sector remains one of the most compelling stories in CRE. Driven by the rapid expansion of AI infrastructure, hyperscale demand, and the relentless pace of digitization, the sector continues to post record-breaking metrics, even as the rules for growth begin to shift.

At the same time, this evolution is bringing new layers of complexity to the market. Land-use challenges, strained power grids, and tightening capital markets are reshaping how investors, operators, and developers think about strategy. The message is clear: the data center boom is far from over, but success now depends on adaptability and innovation.

Investor Confidence Remains Strong

Investor sentiment continues to surge. According to CBRE’s 2025 Global Data Center Investor Intentions Survey, 95% of institutional investors plan to increase allocations to the sector this year, none plan to reduce exposure. The PwC Real Estate Investor Survey points to cloud service providers and hyperscale operators as the most promising growth engines over the next 12 months.

This confidence is reflected in major capital activity:

• Meta is raising $29B from private capital to fund new U.S. AI data centers.

• Vantage Data Centers secured $5B in green loan financing for North American expansion.

• Brookfield acquired 10 data centers across the continent for $1B.

These transactions underscore the depth of investor conviction, and the scale of opportunity ahead.

Development Hits Record Levels

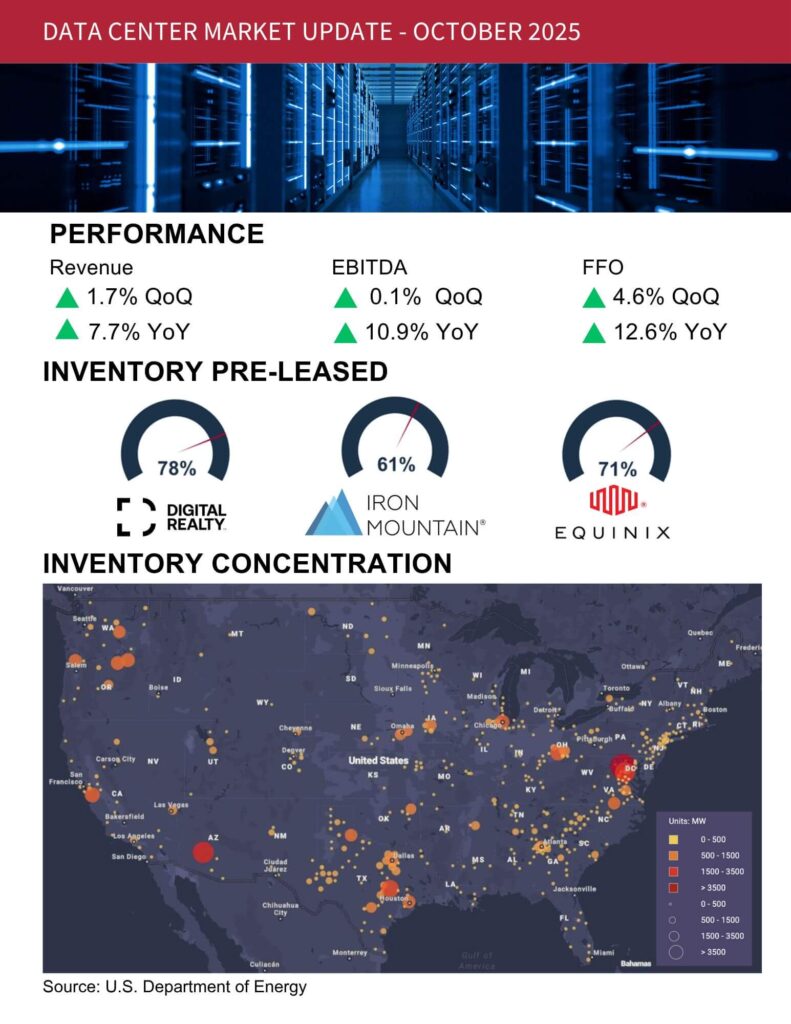

Development activity continues to accelerate. The three largest U.S. data center REITs, Digital Realty, Equinix, and Iron Mountain, collectively expanded their pipelines to $9.8B in active projects, up from just $1.5B in 2021, representing a compound annual growth rate of nearly 65%.

Northern Virginia continues to dominate as the epicenter of activity. With $5.5B in ongoing projects, more than the next six metros combined, the region accounts for nearly three-quarters of the total development pipeline in the Americas.

Meanwhile, the U.S. Census Bureau reports that construction spending on data centers reached $41.1B in 2Q25, marking the tenth consecutive quarter of growth and the highest increase on record.

New Headwinds Are Reshaping Growth

Despite robust demand, the sector is facing headwinds that are forcing a more strategic approach.

From May 2024 to March 2025, more than $64B in data center projects were delayed or blocked due to growing local opposition, driven by environmental, energy, and land-use concerns.

At the same time, power availability has become the defining constraint for expansion. Operators are exploring innovative power procurement strategies, from renewable energy partnerships to private grid development, to meet the surging requirements of AI and cloud workloads.

As interest rates stabilize following the Fed’s recent rate cuts, capital markets are slowly reopening. This shift could provide a tailwind for new projects, but access to capital will increasingly favor operators who demonstrate thoughtful, sustainable growth models.

The Path Forward: Strategy Over Scale

Capright’s analysis points to a clear inflection point. The next wave of data center growth won’t simply be about scale, it will be about strategy.

Operators and investors who focus on the following will be best positioned to outperform as the industry enters its next phase of maturity:

• Creative site selection in emerging secondary markets

• Proactive power procurement to ensure resiliency

• Community engagement to balance growth with local impact

As the update concludes, the fundamentals remain strong, but success will increasingly hinge on the ability to think beyond real estate and align development strategy with energy, technology, and community priorities.

📬 Let’s Talk

At Capright, we are uniquely positioned to support institutional investors, operators, and developers navigating this evolving environment. As an independent valuation and advisory firm, we provide clarity, accuracy, and confidence, especially where the stakes are highest.

If you’d like to discuss the findings or need support with your Data Center valuation or strategy, reach out to:

Principal

📧 koxtal@capright.com

🔗 Connect on LinkedIn

Senior Associate

📧 slore@capright.com

🔗 Connect on LinkedIn