Data Center Market Update – July 2025

July 16, 2025

Please enter your email to download the report

Charting the Future of Digital Infrastructure: Capright’s July 2025 Data Center Market Update

The data center sector continues to experience extraordinary momentum. But as we push further into 2025, it’s clear that the narrative is shifting, not just in terms of growth, but in how that growth is being financed, developed, and sustained.

📈 Key Highlights from the Update:

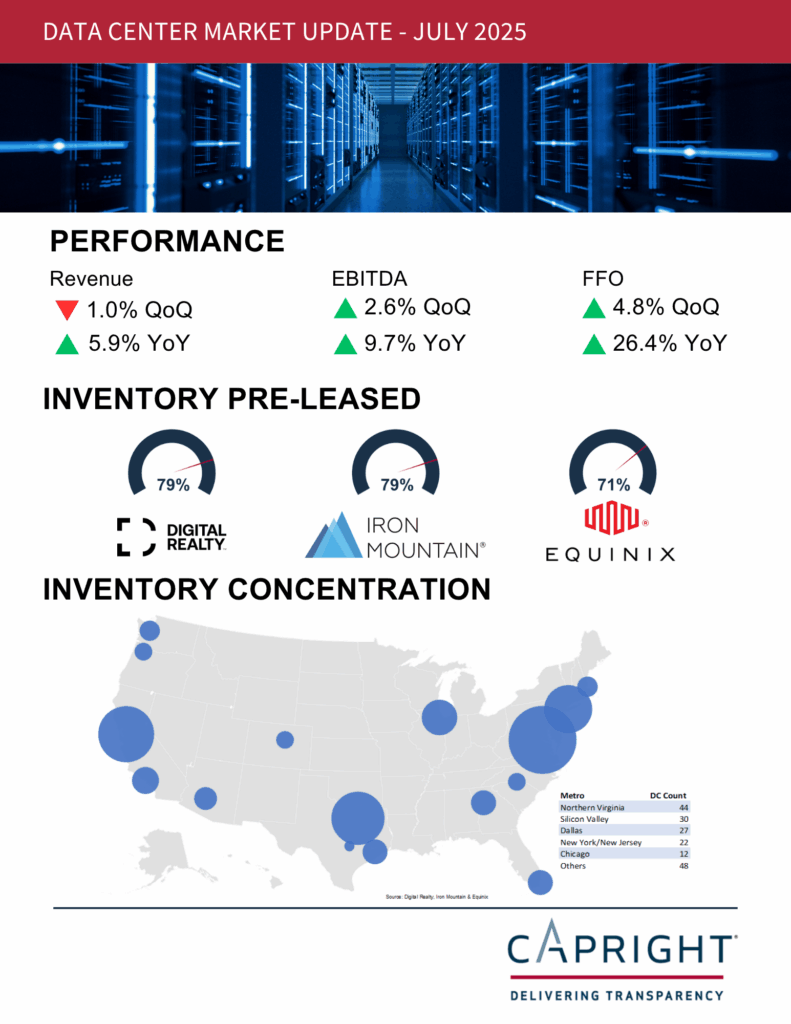

1. Market Performance Remains Strong, Despite Headwinds

• Revenue: +5.9% YoY

• EBITDA: +9.7% YoY

• FFO: +26.4% YoY

Operators like Digital Realty, Equinix, and Iron Mountain continue to show robust financial guidance, reflecting sustained demand from hyperscale users and enterprise clients alike.

2. Construction Activity Breaks Records

• Data center construction spending hit $35.1B in 1Q25, marking the ninth consecutive quarter of growth.

• Major new projects are in motion across NoVA, Dallas, Atlanta, and Portland.

3. Infrastructure Constraints Shape New Development Patterns

• Power and water limitations are emerging as the most significant barriers to traditional hyperscale growth.

• Developers are responding by targeting secondary and tertiary markets where utilities are more readily available and cost-effective.

🏗 Major Capital Commitments Fuel Expansion

The report also highlights some of the most notable capital investments announced this year:

• Amazon: $10B investment in North Carolina

• STACK Infrastructure: $4B in green financing for campuses in Virginia, Oregon, and Toronto

• Crusoe, Blue Owl & Primary Digital Infrastructure: $15B JV in Abilene, Texas

• Digital Realty: $1.7B raised for its first U.S. Hyperscale Fund

• Stonepeak: Launch of Montera Infrastructure with a $1.5B equity commitment

📬 Let’s Talk

At Capright, we are uniquely positioned to support institutional investors, operators, and developers navigating this evolving environment. As an independent valuation and advisory firm, we provide clarity, accuracy, and confidence, especially where the stakes are highest.

If you’d like to discuss the findings or need support with your Data Center valuation or strategy, reach out to:

Principal

📧 koxtal@capright.com

🔗 Connect on LinkedIn

Senior Associate

📧 slore@capright.com

🔗 Connect on LinkedIn