The Self-Storage Market During COVID-19

April 12, 2020

Written by Kris Oxtal MAI, Managing Director

Written by Kris Oxtal MAI, Managing Director

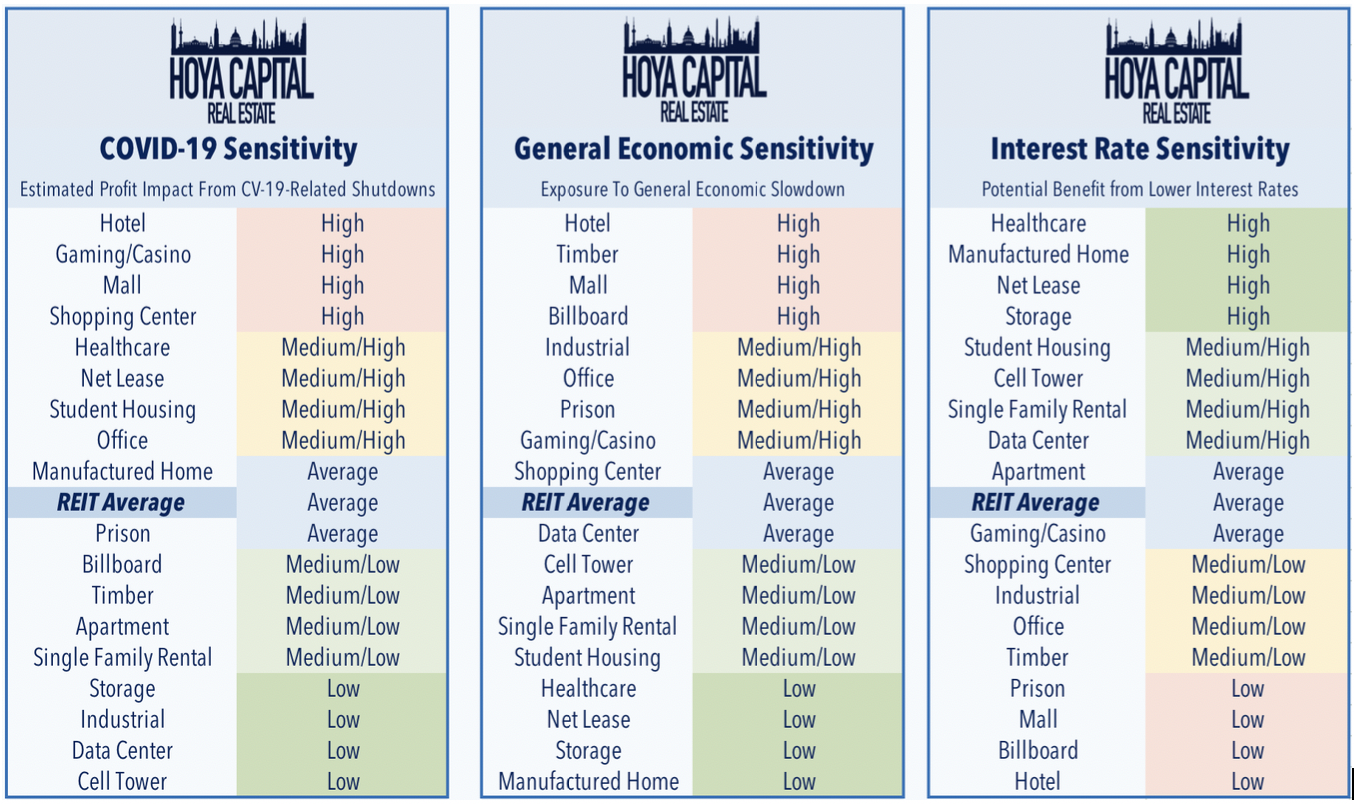

The self-storage market is typically thought of as one of the better positioned asset classes during an economic downturn. During the Great Recession occupancy for self-storage assets held relatively firm while rents are thought to be collateralized by the stored possessions. As shown in the table below, Hoya Capital indicates that self-storage has one of the lowest risks to Economic Sensitivity and COVID-19.

However, no sector will be immune to the near-term impacts of the COVID-19 crisis. More than 16 million jobless claims have piled up in the past three weeks and more claims are expected as shelter-in-place orders continue. Based on discussions with market participants, we have seen the following impacts of COVID-19 on self-storage assets:

- Nearly impossible to borrow from a CMBS lender

- Some lenders are still making loans, but they have the luxury of cherry-picking deals. Only the best deals with strong sponsors are getting done.

- Transactions are expected to slow through the end of the year as buyers become more cautious.

- Self-storage operations are still relatively steady at this point and sellers are not under pressure to dispose of these assets.

- Price renegotiations are expected to increase over the next few weeks.

- One REIT is looking to renegotiate all offers downward by up to 10 percent.

- Cap rates may increase 25 basis points to reflect lower rent growth and near-term concessions/credit loss. The spread between the going-in rate and terminal rate will narrow, as a reflection of heightened near-term risk versus diminished long-term risk. Less emphasis on the Direct Capitalization Approach will be needed to navigate the uncertainties in the near term.

Luke Elliott, Executive Managing Director with Cushman & Wakefield Self Storage Advisory Group indicated the following:

- They have recently closed a handful of deals over the past two weeks with no price renegotiation, though challenging to get to the finish line due to debt.

- Rent growth is expected to pullback and reduce moving forward depending on location and quality of the asset. If the property is adjacent to new development, expect no rent growth in the near term.

- Rent relief and credit loss will be a moving target over the next few months.

- Owners are not looking to increase rental rates on in-place tenants. New leases are being done at market.

- Development deals and C/O deals will be difficult to transact unless at a significant discount. Bridge loans are available but tough to come by and are expensive. Buyers are being advised to add at least 12 months to lease-up with no rental growth through lease-up. The difference in underwriting will likely cause a significant increase to the bid-ask spread on these deals.

- Strong/stable occupancy is key.

Based on discussions with self-storage asset/property management, we have seen the following impacts of COVID-19:

- Tenants with autopayment have started pulling their credit cards.

- Different operators collect rent at different times. Most charge rent on the 1st of the month while others charge monthly from the day you start rents. Therefore, full default rates may not be known until May or June.

- Operators are cutting back staff from 2-3 people to 1 person and paying a premium hourly wage, so there will be some payroll savings in the near term.

- Public Storage and Extra Space had already been working on an online system, whereby tenants could lease a unit entirely online and get into their unit without interacting with property management. These programs will be rolled out earlier than expected. This will continue to help leasing during shelter-in-place orders.

- Operators are expected to be lenient with tenant’s inability to pay. Rents are expected to be worked out for at least a 90-day period. Operators are expected to hold off on auctioning units for a while.

- Peak summer leasing season is expected to be largely lost and material improvement may not come until Summer 2021.