Capright is proud to be the lead sponsor of the 2019 Realizing Returns University Race

February 20, 2019

Capright is proud to be the lead sponsor of the 2019 Realizing Returns University Race where 30 student-lead university teams compete to see which can select a real estate investment portfolio, linked to well-known benchmarks, to produce the highest return over a one-year period. Cash prizes will be given out for quarterly performance, and a top grand prize of $10,000 going to the team with the best total results for all of 2019.

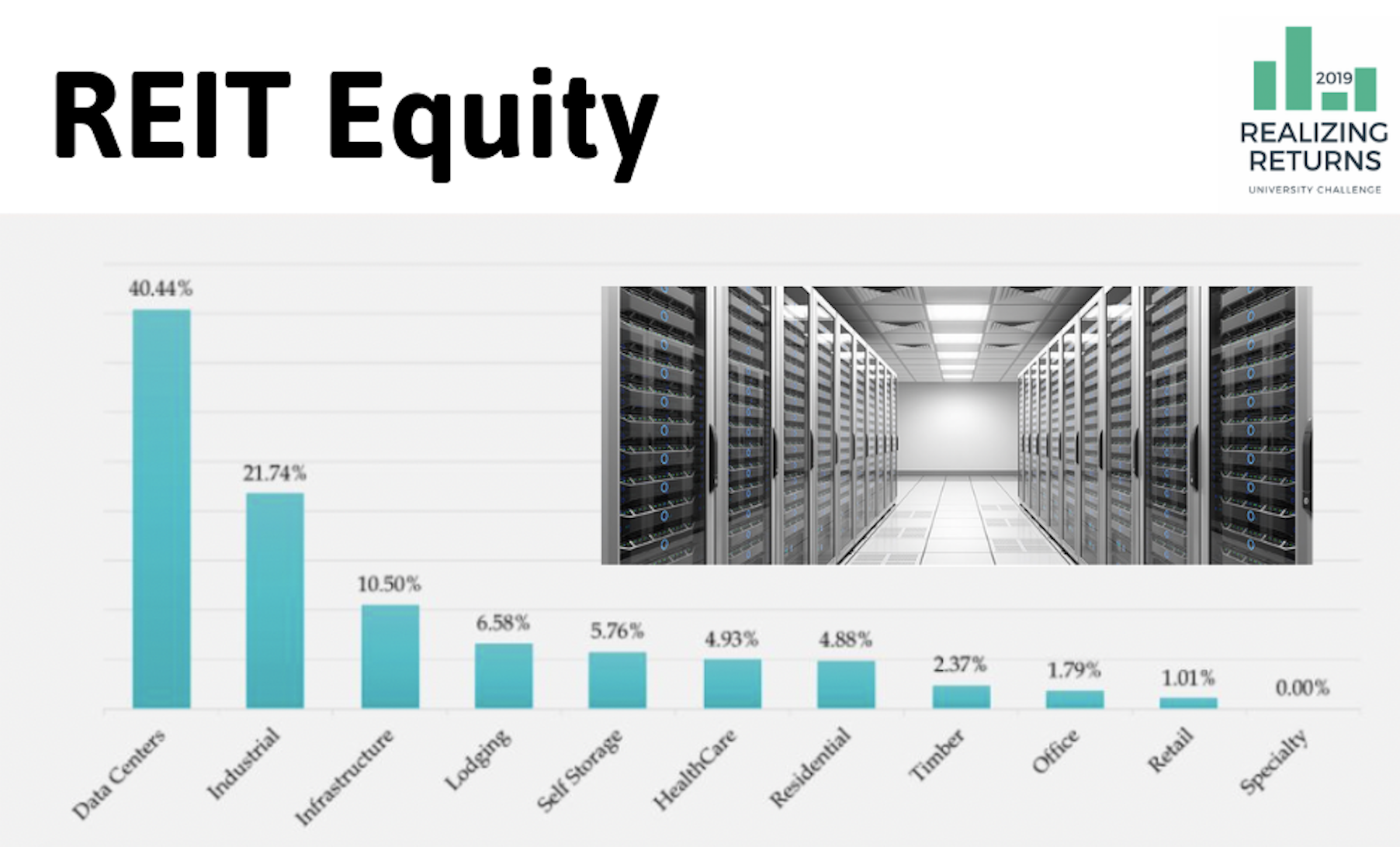

Based on an aggregate of portfolio allocations, this year’s competition is off to a start we could not have predicted. In particular, team trends have moved heavily into private equity investment vehicles, allocating 41.85% to this sector. This larger weight seems to be leaning away from the riskier REIT quadrant that might be due to a concern of more volatile markets and a very long running real estate cycle. Another surprise in their investment strategy is capital investments in REIT Data Centers, reflecting an allocation of 40.44% of that quadrant. The teams’ allocation to this niche property type is dwarfing allocations to the major property types of Industrial (21.74%), Residential (4.88%), Office (1.79%), and Retail (1.01%). While this sort of allocation may not make sense to a core-focused portfolio manager, we can understand the strategy of making bolder bets in an attempt to win! On another level, these allocations are also an acknowledgement that the major real estate sectors may be approaching the end of a long period of expansion.

A special thanks to master real estate economist Chuck DiRocco, CRE, CCIM, FRICS for developing and managing this competition!